Disclosure:

Investment advisory services offered through Foundations Investment Advisors, LLC (“Foundations”), an SEC registered investment adviser. Nothing on this website constitutes investment, legal or tax advice, nor that any performance data or any recommendation that any particular security, portfolio of securities, transaction, investment or planning strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Foundations, execution of required documentation, and receipt of required disclosures. Investments in securities involve the risk of loss. Any past performance is no guarantee of future results. Advisory services are only offered to clients or prospective clients where Foundations and its advisors are properly licensed or exempted. For more information, please go to https://adviserinfo.sec.gov and search by our firm name or by our CRD #175083.

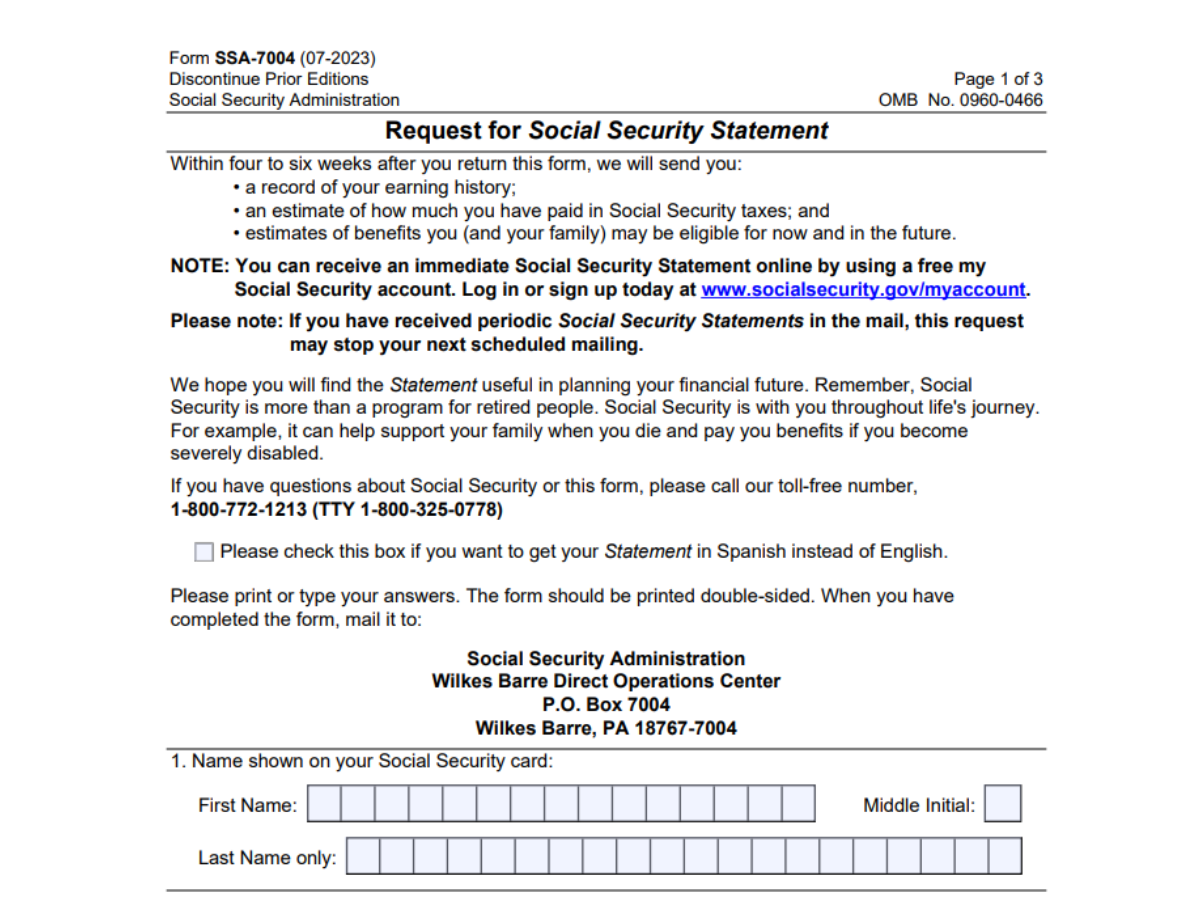

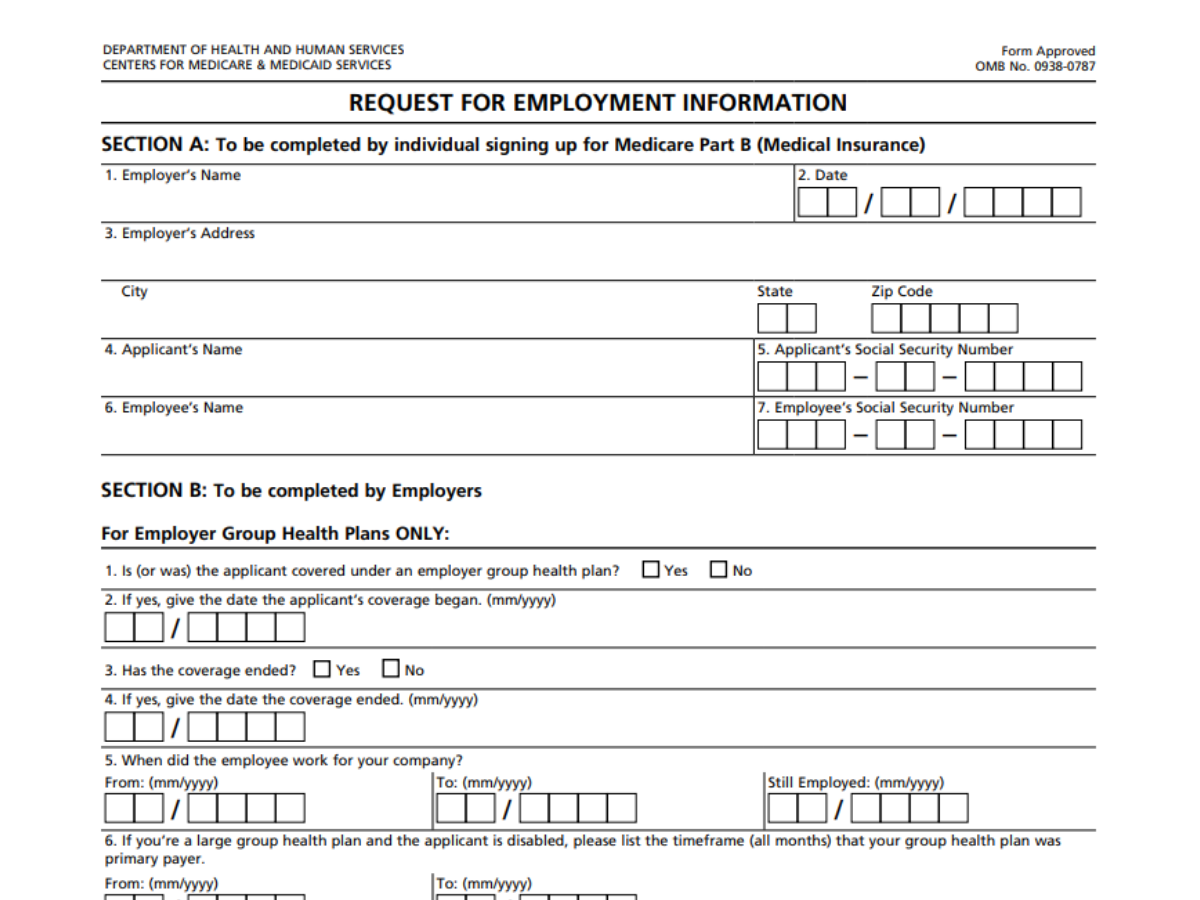

This is not endorsed by the U.S. government or associated with any federal Medicare program. This is not endorsed or affiliated with the Social Security Administration or any U.S. government agency.